Central Bank tightens its monetary policy stance

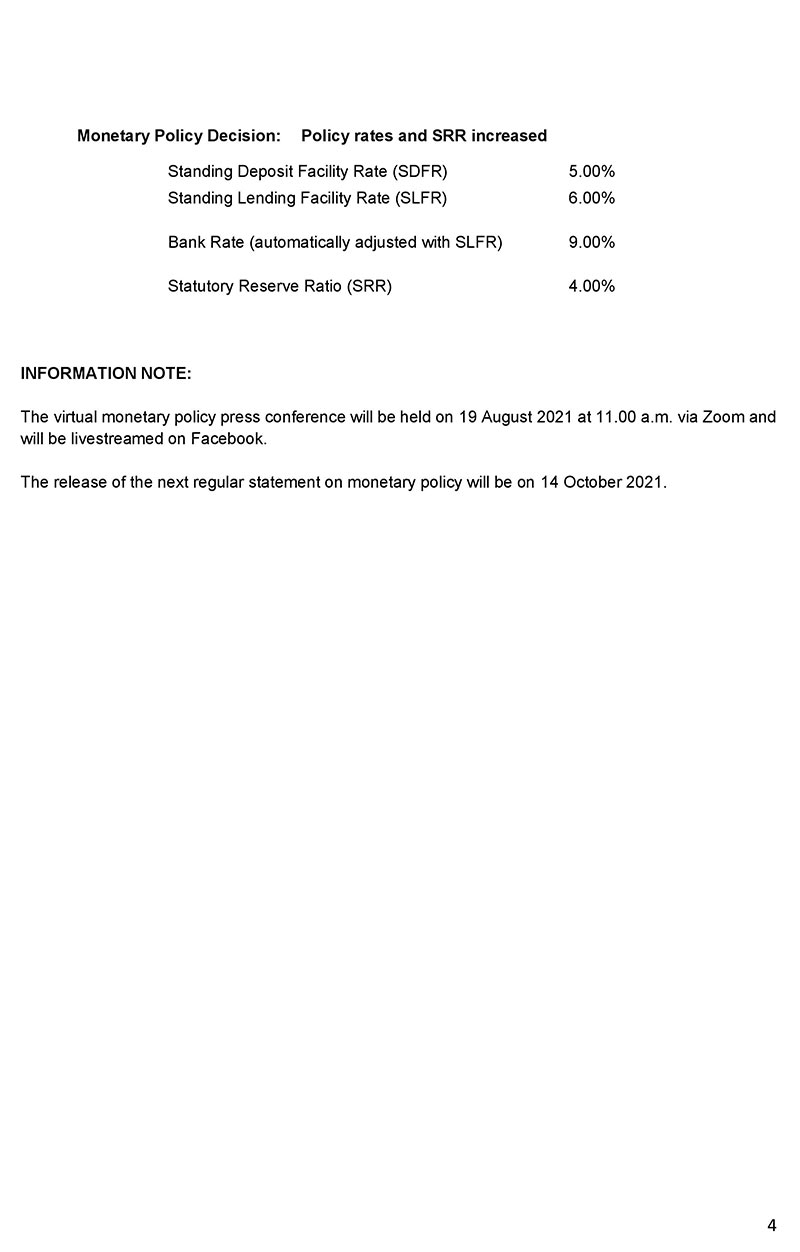

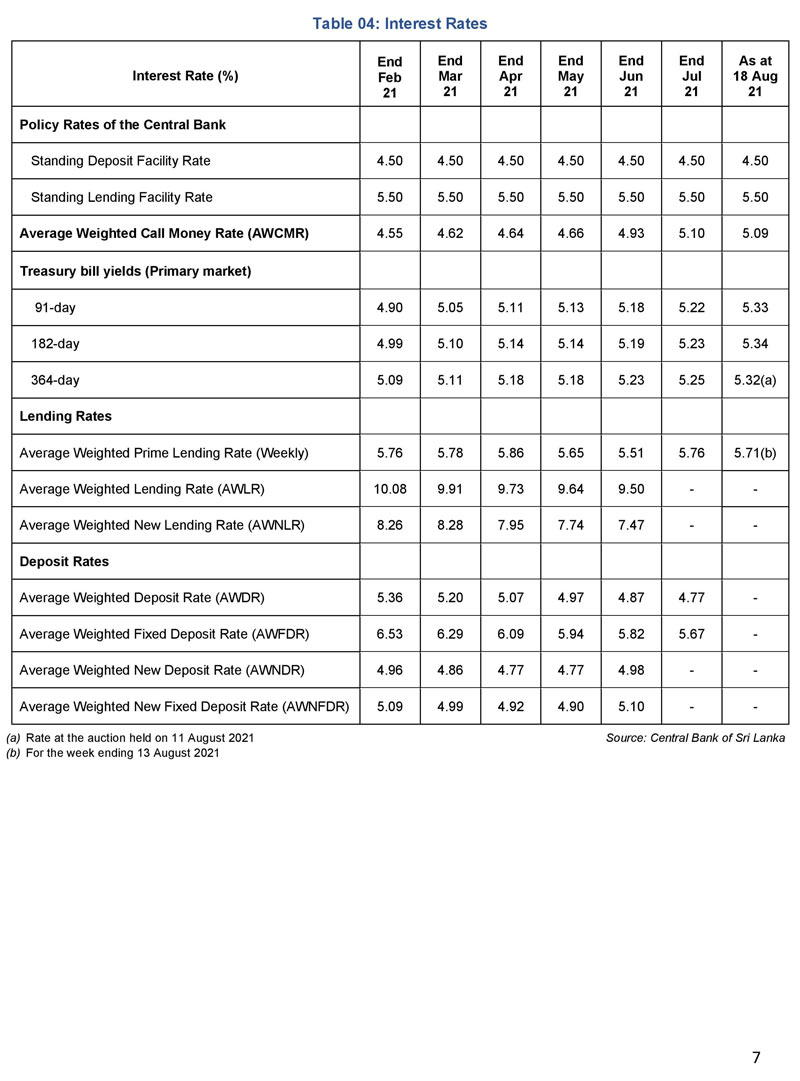

The Monetary Board of the Central Bank of Sri Lanka (CBSL) has decided to increase the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 50 basis points each, to 5.00 per cent and 6.00 per cent, respectively.

The decision was taken at its meeting held on Wednesday (August 18), the Central Bank said in a statement.

In addition, the Monetary Board decided to increase the Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of licensed commercial banks (LCBs) by 2.0 percentage points to 4.00 per cent, with effect from the reserve maintenance period commencing on 01 September 2021.

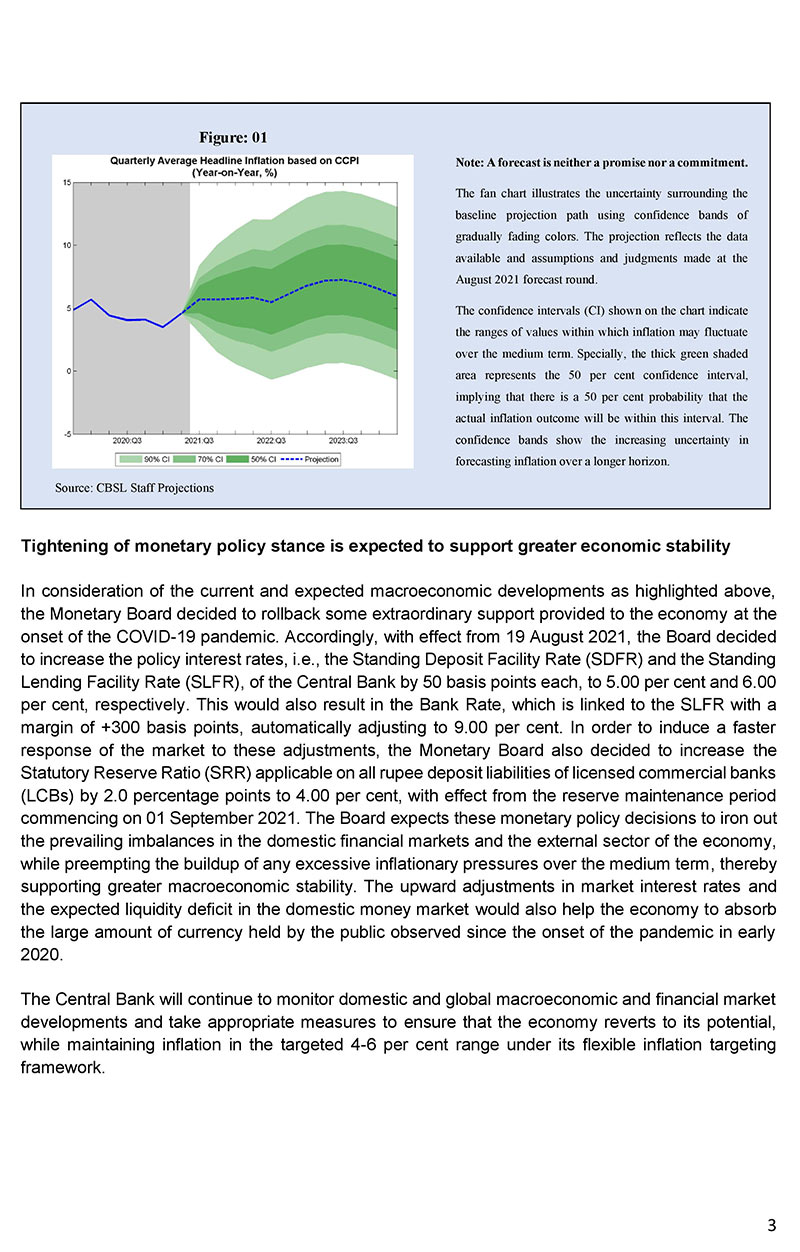

These decisions were made with a view to addressing the imbalances on the external sector of the economy and to preempt the buildup of any excessive inflationary pressures over the medium term, amidst improved growth prospects.

Full statement below:

Latest Headlines in Sri Lanka

- Sri Lanka revises fuel prices from February 1, 2026 January 31, 2026

- Sri Lanka declares essential services to ensure recovery after Cyclone Ditwah January 31, 2026

- Sri Lanka disburses Rs. 50,000 relief to 70% of Cyclone Ditwah victims January 31, 2026

- Sri Lanka to launch national review on social media’s impact on children January 30, 2026

- Sri Lanka, Saudi Arabia move to boost industrial cooperation January 30, 2026