Central Bank tightens its monetary policy stance

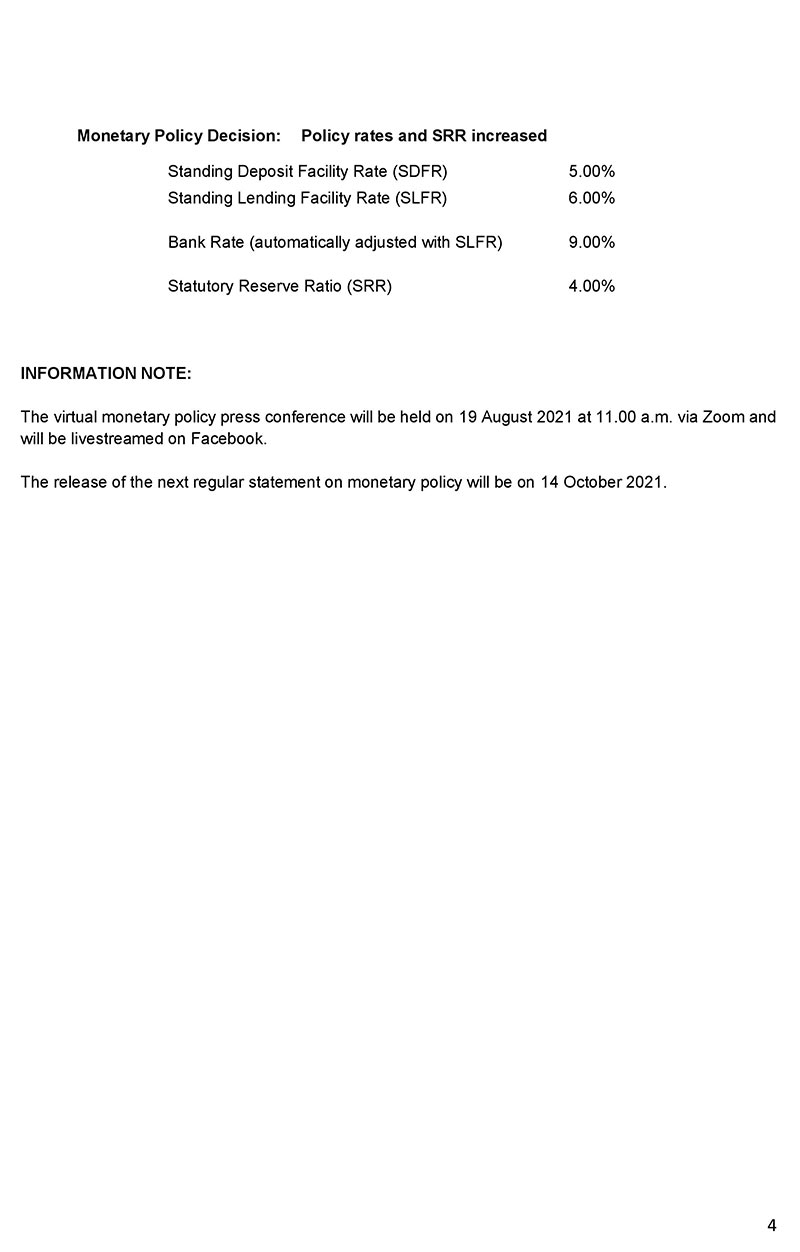

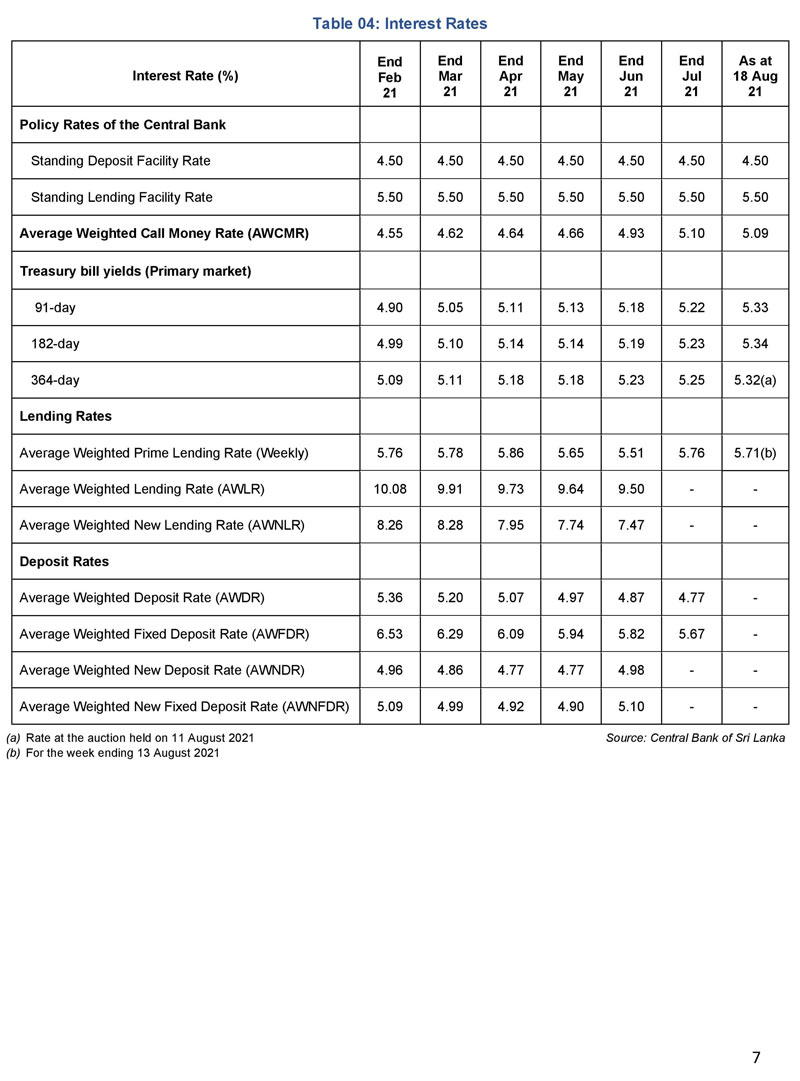

The Monetary Board of the Central Bank of Sri Lanka (CBSL) has decided to increase the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 50 basis points each, to 5.00 per cent and 6.00 per cent, respectively.

The decision was taken at its meeting held on Wednesday (August 18), the Central Bank said in a statement.

In addition, the Monetary Board decided to increase the Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of licensed commercial banks (LCBs) by 2.0 percentage points to 4.00 per cent, with effect from the reserve maintenance period commencing on 01 September 2021.

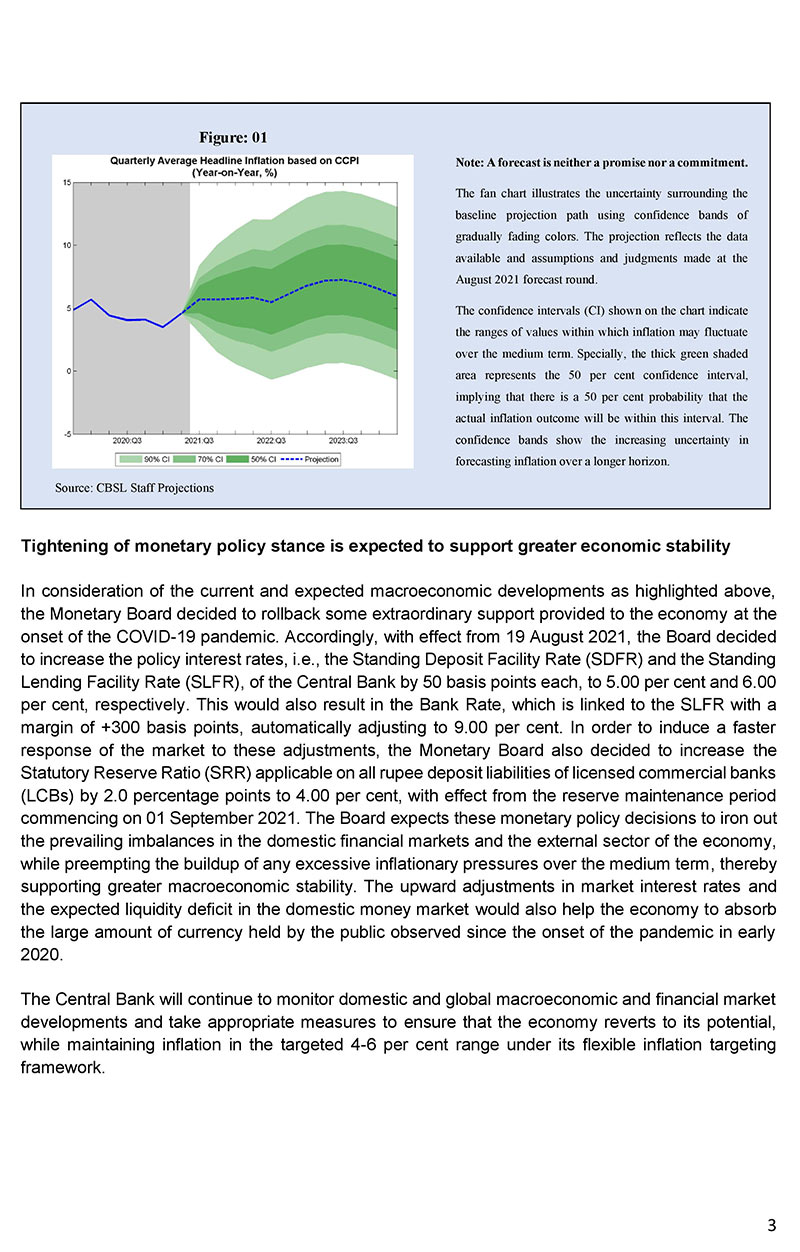

These decisions were made with a view to addressing the imbalances on the external sector of the economy and to preempt the buildup of any excessive inflationary pressures over the medium term, amidst improved growth prospects.

Full statement below:

Latest Headlines in Sri Lanka

- Priyantha Weerasooriya appointed 37th Inspector General of Sri Lanka Police August 13, 2025

- NIMH Acting Deputy Director arrested over bribery allegations August 13, 2025

- Sri Lanka Police introduces WhatsApp number to contact IGP directly August 13, 2025

- Vietnam’s ROX Group eyes major investments in Sri Lanka August 13, 2025

- Suspect arrested with gun and drugs over Meegoda murder August 13, 2025