Central Bank to raise over $5 billion in first quarter

The Central Bank is steaming ahead to raise funds for debt repayments, aiming to raise in excess of $5 billion over the next two months from a range of sources, including currency swaps from India, loans from Chinese banks, an international sovereign bond, lines of credit from State banks, as well as Panda and Samurai bonds, a top official said yesterday.

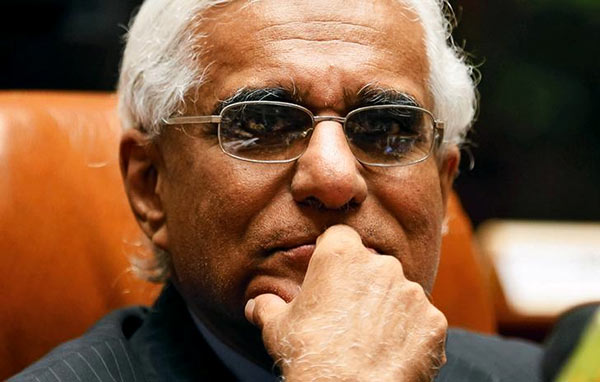

Central Bank Governor Dr. Indrajit Coomaraswamy, speaking at the Ceylon Chamber of Commerce (CCC) 2019 outlook launch, acknowledged the monetary authority was scrambling to raise funds to meet $5.9 billion in debt repayments this year, of which $2.6 billion needs to be met in the first quarter.

“Money had been lined up with various lenders to mobilise the resources that we need, but they fell into abeyance and we had to start all over again.

But there is real urgency, because total external debt repayments amount to $5.9 billion, of that $1.2 billion ISBs that can be rolled over, effectively we need to borrow about $3 billion of new money. In the first quarter, there is $2.6 billion worth of repayments, including the $1 billion repayment on Monday,” he told the gathering.

Having had its plans derailed during the seven-week constitutional crisis, the Central Bank repaid $1 billion in debt on Monday from its reserves, and has reached out to India and China to bolster reserves to acceptable levels by the end of January.

“We are now moving very quickly to raise the money that we need. Here we have to really acknowledge the role of Sri Lanka’s friends. The Reserve Bank of India (RBI) very quickly agreed to give us $400 million as a swap. In addition, they are actively considering a bilateral swap of $1 billion, but this is really short term as swaps are usually for three to six months, but given this crunch we have, this money is clearly very helpful. Bank of China, which has a branch in Sri Lanka, has agreed to give a three-year loan at very attractive interest rates, and they have also said they would give us the money by the end of the month,” Dr. Coomaraswamy said.

The loan from Bank of China is likely to come at an interest rate of about 5.5%.

“We are very keen to get this money into our reserves by the end of the month, so that the reserve number published at the end of the money gives sufficient confidence to markets. The $300 million loan being negotiated with Bank of China can be scaled up to $1 billion. The reason we broke it up is because the approval process from the Bank of China side takes a long time, but they could give us $300 million.”

In addition, the Central Bank is also working to upscale a $1 billion loan from China Development Bank, which was received in the last quarter of 2018, by a further $500 million. These funds would also be available in February. “Sri Lanka’s friends, the two regional giants, have stepped up to support us in this time when we were pushed into a rather difficult corner.”

The Central Bank is also moving quickly to ready to issue an International Sovereign Bond (ISB). Cabinet approval was granted this week to borrow up to $2 billion, of which a large potion would be a dollar denominated ISB, but the Central Bank would also likely issue Panda and Samurai bonds, as announced last year.

“We want to try and get all these transactions done in the first quarter of this year. The job of Central Banks is to prepare for the worst and we learnt a lesson on 26 October. We don’t know what political tsunami might come next, so we have to plan and get the money in as fast as possible.”

State banks Bank of Ceylon, People’s Bank, and National Savings Bank are raising lines of credit on behalf of the Government. National Savings Bank is negotiating a $750 million line of credit, while People’s Bank is currently on a road show in the Middle East. The Central Bank expects Bank of Ceylon and People’s Bank to jointly raise $200 million to $300 million.

Acknowledging that 2019 would likely be a year with modest growth, the Governor noted that structural reforms were essential to improve exports, and investment to reduce debt and improve economic expansion. Changes in monetary policy would be unlikely, as there is little space for manoeuvring and would only result in short term “sugar high” growth, he warned.

Dr. Coomaraswamy argued that a 19% depreciation of the rupee was not as deeply negative as generally believed by the public, as it improved the competitiveness of exports, and provided incentive for import substitution industries. He also contended that the pass through to inflation was much less, given commodity prices are presently at a low point, and the Central Bank had shifted to an inflation targeting regime that aims to keep inflation at single digit levels. Nonetheless, Dr. Coomaraswamy conceded that the rate of depreciation would be reduced this year, and the Central Bank would consider easing policy rates if the economic environment improved.

(Source: Daily FT – By Uditha Jayasinghe )

Latest Headlines in Sri Lanka

- Six police officers arrested over alleged priest assault granted bail January 29, 2026

- Sri Lanka moves toward ‘Dream School’ system for all grades January 29, 2026

- ASP Rohan Olugala appointed Director of Walana Anti Corruption Unit January 29, 2026

- Sri Lanka launches five-year national action plan to combat human trafficking January 29, 2026

- Équité launches media guidelines to protect LGBTIQ+ rights in Sri Lanka January 28, 2026