Sri Lanka revamps Withholding Tax: Relief for low-income earners

Deputy Minister of Industry and Entrepreneurship Development, Chathuranga Abeysinghe, has announced a significant reform in the Withholding Tax (WHT) policy, aiming to create a fairer taxation system for Sri Lankan citizens.

In a Facebook post on March 30, Abeysinghe criticized the previous administration’s handling of WHT, stating that non-taxpayers who had 5% deducted from their bank interest had little to no chance of recovering those funds. He clarified that WHT is not an actual tax but rather an advance collection mechanism.

Under the newly introduced system, individuals whose annual taxable income, including bank interest, is less than LKR 1.8 million can now submit a self-certification to their bank. Once certified, no WHT will be deducted from their bank interest, eliminating the need for lengthy and complex refund processes at the Inland Revenue Department. The same benefit extends to children’s savings accounts, with parents able to provide certification on behalf of their children.

For those earning above LKR 1.8 million annually, WHT will be applied at a rate of 10%. However, the deducted amount can be offset against their annual tax liability, ensuring fair treatment for all taxpayers. The minister emphasized that this approach encourages every income earner to open a tax file while protecting lower-income individuals from unnecessary deductions.

Abeysinghe also addressed recent protests against the government’s tax reforms, claiming that those demonstrating were non-taxpayers. He argued that the opposition was attempting to mislead the public and would now lose a key talking point in the upcoming local government elections.

Looking ahead, the government plans to introduce further measures to expand the tax base. Abeysinghe noted that while Sri Lanka has a low number of formal tax files, nearly 1.5 million individuals who should be paying taxes are currently evading them.

The new WHT policy is expected to provide relief to lower-income earners while promoting a more structured and equitable taxation system in the country.

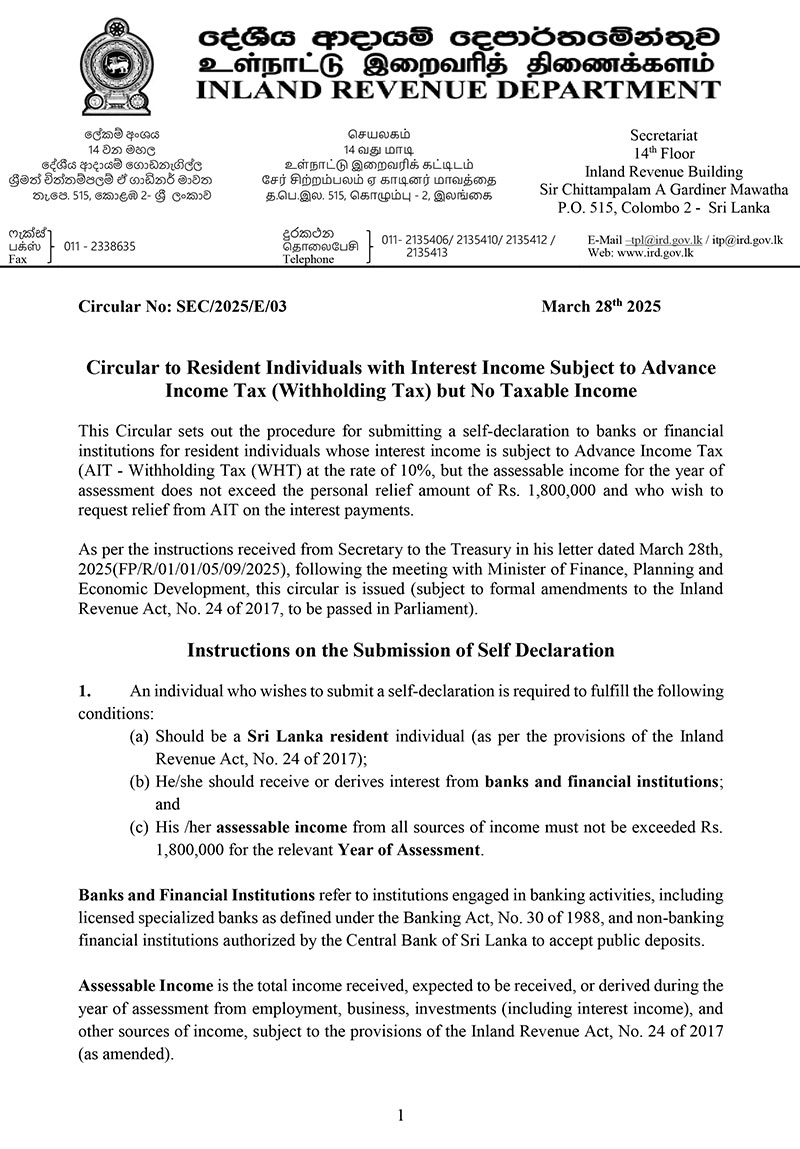

Deputy Minister Abeysinghe made these remarks by referring to a circular issued by the Inland Revenue Department, dated March 28, 2025.

Latest Headlines in Sri Lanka

- Sri Lanka expands Internal Affairs Units to 250 more state institutions January 30, 2026

- Three arrested over Rs. 17 Million Lanka Sathosa garlic scam January 30, 2026

- Businessman arrested over Rs. 30 Million money laundering case linked to former minister January 30, 2026

- Six police officers arrested over alleged priest assault granted bail January 29, 2026

- Sri Lanka moves toward ‘Dream School’ system for all grades January 29, 2026